AutoQL for Financial Services Software Users

~3 minute read

Managing costs is a critical part of maintaining the profitability of a business. Financial advisors and client relationship managers supporting their business clients need to understand how their clients are approaching cost management when they assess risk, approve loans, and advise the business about securing additional funding.

Effectively advising clients on strategic cost management practices helps ensure that the client can repay any loans the bank has provided. It’s also a high-value advisory service that clients come to rely on, ensuring that they continue to return to their provider to help them manage their financial wellness and grow their wealth as time goes on.

Read more: Deliver the Data that Helps Advisors Assess Risk, on Demand

To provide actionable suggestions, advisors and relationship managers need to be able to take a look at the numbers to determine what their core cost management objectives are and, subsequently, where costs may need to be cut.

This data discovery process can be intensive, requiring advisors to sift through various statements and manually calculate ratios that provide them with a high-level perspective about where their clients might need to reduce expenses.

With AutoQL, it’s easy for advisors and client relationship managers to simply ask for the data they need to understand each client’s position and opportunities, and ultimately offer meaningful, data-informed advice. Leveraging an embedded conversational data solution from within the software they’re already using to manage client portfolios, advisors can uncover the true story data tells about their clients’ businesses, instantly and intuitively.

Data on demand makes it easy to find unique insights and explore different aspects of a business, so advisors can provide strategies ensure their clients stay ahead.

For example, a busy day at the bank requires an advisor to be prepared to meet with many different clients, all with very different businesses. Going into their meetings, they need to be able to quickly access information that is unique to each business, so that they can give the best and most relevant advice when their client asks questions in the moment.

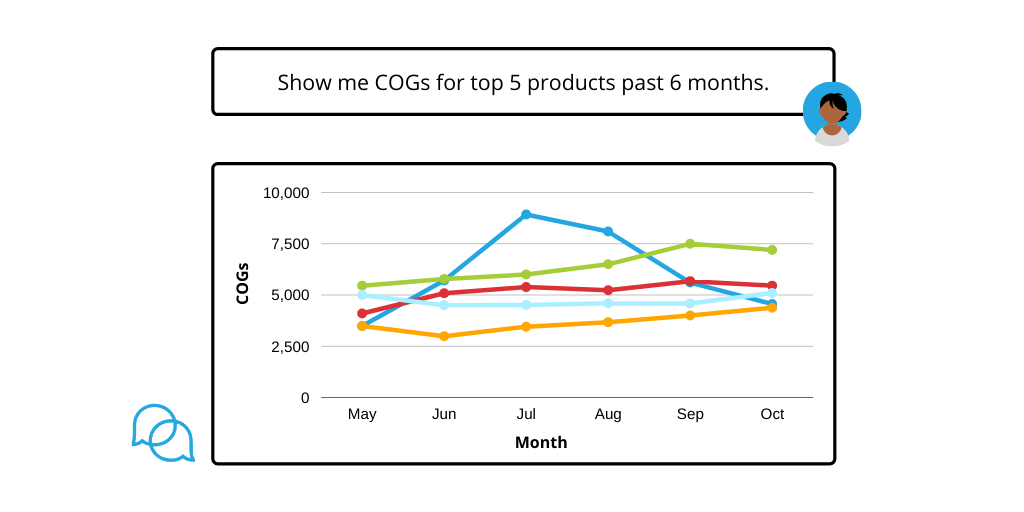

On a virtual call with a retail client who is wondering about how they can sustainably cut costs, the advisor can start by simply requesting “COGs past 6 months” or even seek out more granular details by asking “Show me COGs by product past 6 months” or “Show COGs for 5 lowest selling items last 6 months”. They could also ask “Show accounts payable by account by month last 6 months” to see where the business is paying the most in operating costs like rent.

Read more: Provide Cash Flow Data for Client Relationship Managers, Instantly

The advisor can suggest that their client consider renegotiating rates with suppliers or spend time exploring inventory-optimizing strategies, allowing them to engage meaningfully with their client on the call and provide data-driven insights that have real value.

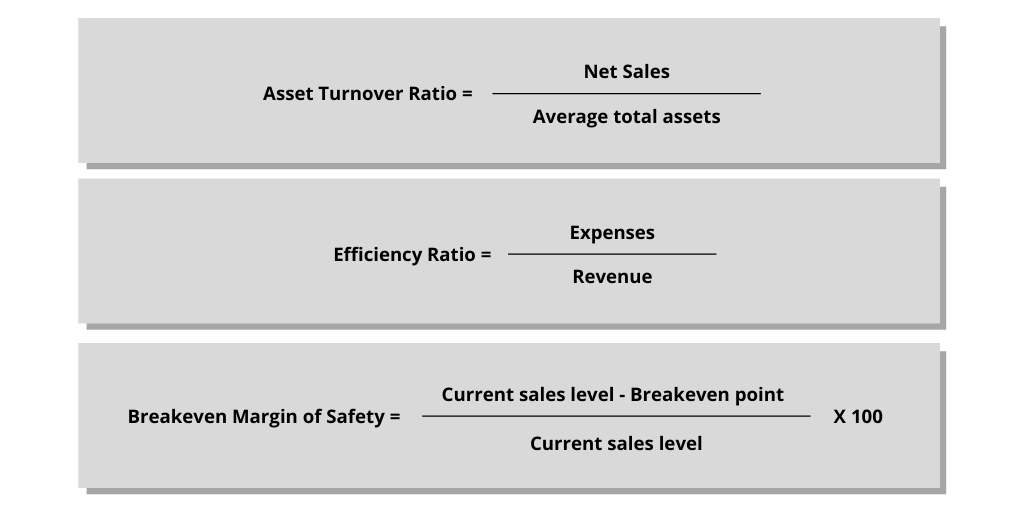

Typically, these calculations are done manually. With AutoQL, users can just ask for the ratio and the answer is returned immediately.

The advisor can also streamline their analysis when completing more comprehensive assessments. They could ask questions like “What is the asset turnover ratio for client X?” to help the client about needing to address how their production or management costs may be slowing their growth.

They could also ask “What is the efficiency ratio?” or “What is the breakeven margin of safety for client X” to keep a pulse on whether the business can continue to cover their ongoing expenses.

For banks with proprietary software or legacy systems looking to improve their relationships with clients while ensuring that they only take on the most eligible businesses, more efficient access to data means that they can provide more powerful advisory and keep a better eye on whether a client is headed for trouble.